Weekly Market Report

For Week Ending November 12, 2016

The sudden elevation in mortgage rates after the election may throw a wrench into the market for both buyers and sellers. Affordability and inventory are already low, and rate spikes coupled with rising prices may keep buyers at bay. In return, potential sellers may forgo selling if they have to lower their asking prices. These are hypothetical situations, of course, and residential real estate is presently performing well.

In the Twin Cities region, for the week ending November 12:

- New Listings decreased 3.8% to 986

- Pending Sales decreased 2.7% to 857

- Inventory decreased 19.0% to 12,334

For the month of October:

- Median Sales Price increased 6.5% to $230,000

- Days on Market decreased 14.3% to 60

- Percent of Original List Price Received increased 0.8% to 96.9%

- Months Supply of Inventory decreased 21.2% to 2.6

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Strong Demand, Rising Prices, but Weak Supply Heading into Winter

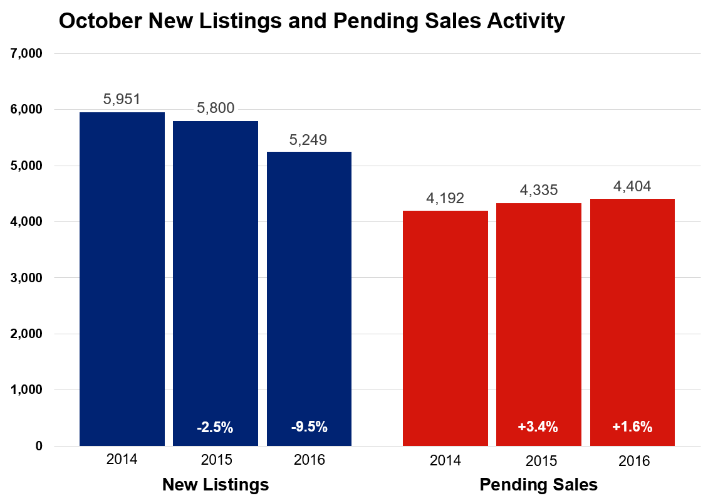

Pending home sales rose 1.6 percent compared to last year and reached their highest level for any October since 2004. Sellers listed 5,249 for-sale properties on the market, 9.5 percent fewer than last October. Closed sales increased 0.8 percent to 4,791. That closed sales figure is between 2004 and 2005 levels. Although home prices have reached their seasonal peak for 2016, the median sales price increased 6.5 percent from last year to $230,000. Buyers are still frustrated by a lack of options. Inventory levels fell 19.0 percent to 12,625 active properties. Additional listings are needed to ease the current supply shortage—especially at the entry-level and first-time buyer price points.

Multiple bids on attractive listings are common in low inventory environments, and homes tend to sell quickly. Days on market until sale fell 14.3 percent to 60 days. The average percent of original list price received at sale was 96.9 percent, 0.8 percent higher than last year. But the median percent of current list price received is 99.6 percent, the highest level since 2005. Months supply of inventory fell 24.2 percent to 2.5 months—the lowest October figure on record since the beginning of 2003. This indicator measures the balance between supply and demand in the marketplace. Generally, five to six months of supply is considered a balanced market. Less than that indicates a seller’s market.

“Demand is still soaring while listing activity has weakened,” said Judy Shields, Minneapolis Area Association of REALTORS® (MAAR) President. “Partly because of that, we expect prices to remain firm through the winter months barring any unforeseen events.”

The strongest sales activity over the last 12 months is in the $190,000 to $250,000 range, followed by the $250,000 to $350,000 range. Although single family sales dominate the Twin Cities market by number, condo and townhome sales witnessed the largest year-over-year sales increase. Similarly, while previously-owned properties make up the largest share of sales, newly constructed properties had a stronger year-over-year gain.

A healthy Twin Cities labor market has been conducive to housing recovery. The most recent national unemployment rate is 4.9 percent, though it’s a healthier 3.3 percent locally. The Minneapolis-St. Paul-Bloomington metropolitan area has the fourth lowest unemployment rate of any major metro area.

Locally, the 30-year fixed mortgage rate stands at 3.55 percent compared to a long-term average of about 8.0 percent. Rates are still near their lowest levels in three years. Marginally higher rates were widely expected in 2016, but the Federal Reserve hasn’t moved rates since last December. Even though the Fed was widely expected to raise rates this December, market volatility could change that.

“Buyers are still very much motivated by the current environment, it’s weak seller activity that is holding this market back,” said Cotty Lowry, MAAR President-Elect. “As this recovery moves into its sixth year, it’s critical to remember that markets and economies are never ‘due’ for a decline the way the Cubs were ‘due’ for a World Series win. There is usually a reason.”

From The Skinny Blog.

Weekly Market Report

For Week Ending November 5, 2016

It is unclear how having elected the first business person with no prior political experience and a heavy background in real estate as the nation’s president is going to influence the housing market. In the hours and days after the election, financial markets became quite volatile due to the uncertainty. However, it doesn’t seem as though demand from aspiring home buyers will be shrinking in the near future.

In the Twin Cities region, for the week ending November 5:

- New Listings decreased 7.4% to 1,096

- Pending Sales increased 9.4% to 980

- Inventory decreased 17.8% to 12,706

For the month of October:

- Median Sales Price increased 6.5% to $230,000

- Days on Market decreased 14.3% to 60

- Percent of Original List Price Received increased 0.8% to 96.9%

- Months Supply of Inventory decreased 21.2% to 2.6

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

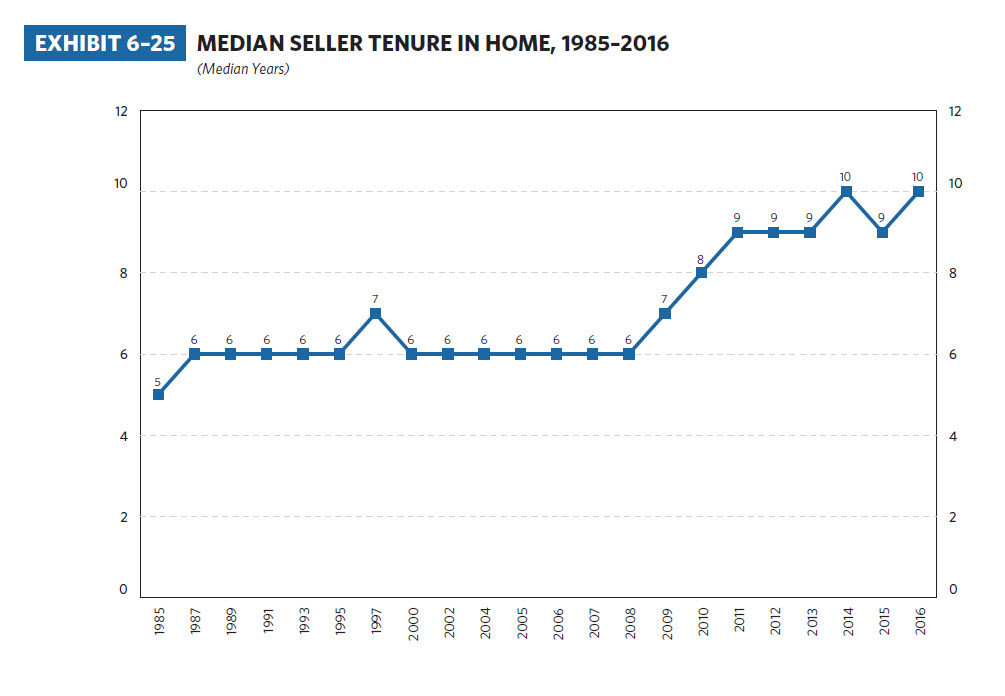

Median Seller Tenure in Home (1985-2016)

For quite some time, NAR’s reports have shown that homeowners tend to stay in their homes for 5-7 years. Based on the data from NAR’s most recent Profile of Home Buyers and Sellers report, that was true up until 2008. By 2011–just after the seismic shifts that rocked the market–owner tenure rose to 9 years and has been range-bound between 8-10 years since 2010. The current 2016 median tenure stands at 10 years. In summary, owning a home used to be a 5-7 year proposition, but owners now tend to be staying in their homes between 8-10 years.

The fact that sellers are staying in their homes longer since the downturn is partly responsible for our low inventory levels. That said, this is still a median, meaning that half of homeowners spend less than 10 years in their home. At first, a relatively large share of homeowners were underwater and thus couldn’t sell (not the case anymore). But then rising prices, historically low rates and an improving economy caused buyer demand to surge far more quickly than listing activity. That has created a situation where sellers are confident about getting strong offers on their homes quickly, but they’re hesitant about being a buyer in this competitive and under-supplied marketplace. Many are making the decision to stay and possibly remodel their current space rather than competing and possibly making full price offers or better on the most desirable homes.

Don’t expect quick resolution on the inventory shortage. New construction activity isn’t helping to alleviate the shortage because it’s not profitable to build at the entry-level or first-time buyer price point. We’re optimistic about things loosening up a tad come Spring 2017, but it will take time for the market to rebalance and regain its footing.

Although this recovery has sent sales and prices more or less back to peak levels, the hunt for equilibrium continues.

From The Skinny Blog.

Weekly Market Report

For Week Ending October 29, 2016

We enter the fourth quarter of the year knowing that the share of first-time home buyers rose for the first time in approximately three years. This fact is driven primarily by healthy job growth, but we need to see more homes entering the market in order to combat the low inventory struggle witnessed during the entirety of 2016.

In the Twin Cities region, for the week ending October 29:

- New Listings decreased 6.1% to 1,031

- Pending Sales increased 4.2% to 966

- Inventory decreased 16.9% to 13,299

For the month of September:

- Median Sales Price increased 3.6% to $230,000

- Days on Market decreased 13.8% to 56

- Percent of Original List Price Received increased 0.9% to 97.5%

- Months Supply of Inventory decreased 17.1% to 2.9

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending October 22, 2016

Even though there are still more than two months remaining on the year, there is little to suggest that the prevailing trends of 2016 will suddenly change. If all holds firm, inventory will trend lower, prices will trend higher and sales will show that demand remains strong, despite having fewer homes to choose from.

In the Twin Cities region, for the week ending October 22:

- New Listings decreased 4.7% to 1,174

- Pending Sales increased 8.2% to 1,001

- Inventory decreased 15.9% to 13,632

For the month of September:

- Median Sales Price increased 3.6% to $230,000

- Days on Market decreased 13.8% to 56

- Percent of Original List Price Received increased 0.9% to 97.5%

- Months Supply of Inventory decreased 20.0% to 2.8

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

October Monthly Skinny Video

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!