- The median sales price increased 4.5% to $357,700

- Signed purchase agreements rose 13.1%; new listings up 34.5%

- Market times fell 3.3% to 59 days; inventory up 13.3% to 6,665

(Mar. 18, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both buyer and seller activity rose in February. Homes also sold in less time and at higher prices.

Sellers, Buyers and Housing Supply

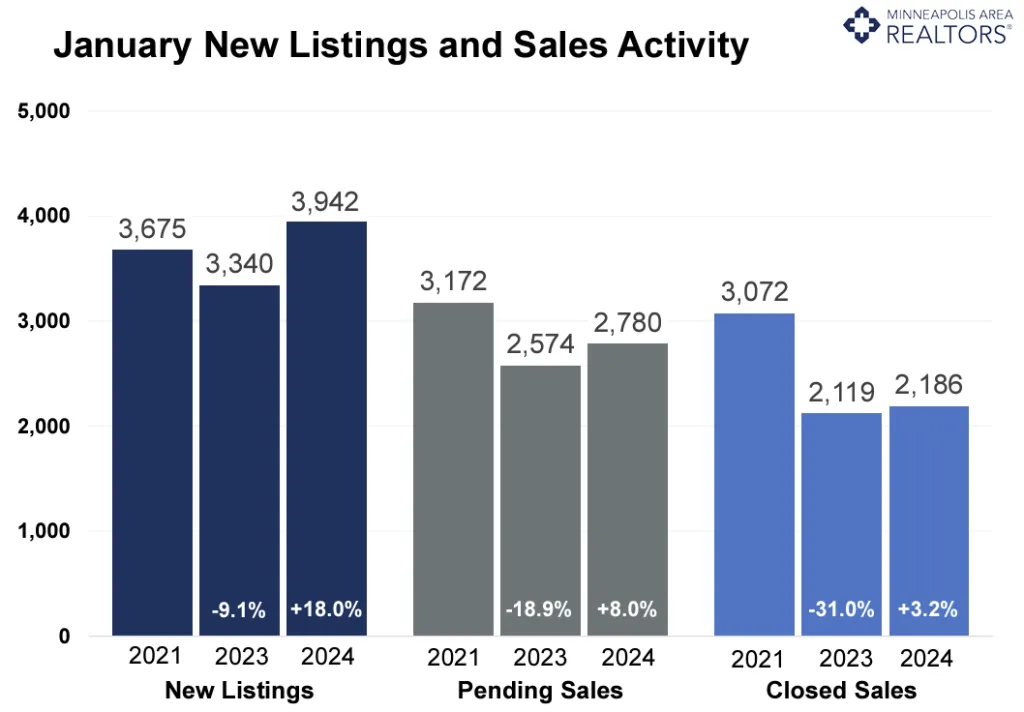

With four consecutive year-over-year increases in new listings and three consecutive year-over-year increases in pending sales, the market turnaround narrative is gaining traction. While inventory levels were up, potential buyers should understand that the market remains significantly undersupplied. In February, sellers listed 34.5% more homes on the market and buyers signed 13.1% more purchase agreements. Sellers unwilling to give up their favorable mortgage rate have withheld listings due to the “rate lock-in effect” but now there is a backlog and we’re seeing some of that activity being released. Buyers had also delayed their purchases until rates came down or until they had some earnings growth, were more able to save for a downpayment and saw more inventory that met their needs. While supply and demand normalize, buyer and seller activity won’t immediately return to previous highs. That will take time—but just how much depends on both market and economic factors. Since these seemingly strong gains are skewed by a low baseline period, it’s not that activity has surged recently as much as activity declined last year at this time due to the Federal Reserve’s inflation fight and rate hikes.

Inventory levels are on the rise in the metro, up 13.3% compared to last February. Those out shopping for homes during this spring market should expect both more listings from pent-up sellers but also more competition from pent-up buyers. In that sense, activity levels will be higher but the balance between supply and demand will remain tight. But if rates do fall further, that could induce even more demand which would cause a resurgence in multiple offer situations and homes selling for over list price. “Perhaps it’s still early to make the call, but it sure feels like we’ve reached a turning point,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “Despite the market ramping up, buyers are still cautious and deliberate but also more optimistic.”

Prices, Market Times and Negotiations

Supply levels are too low for prices to fall but rates are too high for prices to rise much. The median sales price rose 4.5% to $357,700, which amounted to $203 per square foot. During the month, sellers accepted offers at 97.5% of list price after 59 days compared to 97.2% in 61 days last February. Sellers still enjoy pricing power and the upper hand in general but some are having to make concessions by way of price reductions, some seller paid closing costs and other tactics. “There is definitely some momentum heading into spring market,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “But turnarounds rarely happen overnight. Builders play a key role, lenders are being more innovative and consumers are persistent and more realistic.”

Location & Property Type

Market activity always varies by area, price point and property type. New home sales rose at over twice the rate of existing home sales. Single family sales rose at over twice the rate as townhomes. Sales over $500,000 rose at over three times the rate of sales under $500,000. Cities such as Shorewood, Forest Lake, Minnetrista and New Richmond saw among the largest sales gains while Crystal, Andover, Buffalo and Inver Grove Heights all had notably weaker demand. For cities with at least five sales, the highest priced areas were Medina, Orono, North Oaks and Lake Elmo while the most affordable areas were Red Wing, Zumbrota and Vadnais Heights.

February 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 4,667 properties on the market, a 34.5% increase from last February

- Buyers signed 3,308 purchase agreements, up 13.1% (2,614 closed sales, up 11.2%)

- Inventory levels rose 13.3% to 6,665 units

- Month’s Supply of Inventory rose 28.6% to 1.8 months (4-6 months is balanced)

- The Median Sales Price was up 4.5% to $357,700

- Days on Market was down 3.3% to 59 days, on average (median of 38 days, down 13.6%)

- Changes in Pending Sales activity varied by market segment

- Single family sales rose 16.8%; condo sales were up 5.4%; townhouse sales increased 7.0%

- Traditional sales were up 12.8%; foreclosure sales rose 45.5% to 48; short sales were up 37.5% to 11

- Previously owned sales increased 11.0%; new construction sales rose 26.6%

- Sales under $500,000 were up 8.9%; sales over $500,000 increased 30.3%

For Week Ending March 9, 2024

For Week Ending March 9, 2024