For Week Ending October 15, 2022

For Week Ending October 15, 2022

Median national rents fell slightly to $1,759 in September, marking the second consecutive month rents have dropped, according to a recent report from Realtor.com. Although median rents remain 7.8% higher than a year ago, it represents the smallest year-over-year increase and the slowest annual rate of growth since June 2021, suggesting the rental market may be cooling after the record-breaking pace of the last two years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 15:

- New Listings decreased 14.0% to 1,266

- Pending Sales decreased 37.3% to 835

- Inventory increased 4.0% to 9,071

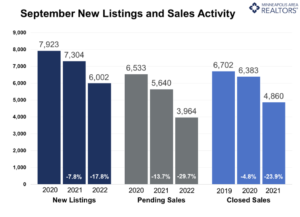

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,050

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.