For Week Ending June 12, 2021

For Week Ending June 12, 2021

U.S. median rental prices increased 5.5% year over year for an average of $1,527 in May, exceeding pre-pandemic figures and putting rents at their highest level in two years, according to realtor.com’s Monthly Rental Report. Meanwhile, after months of record highs, lumber prices have finally begun falling, with futures for July delivery down 41% since May’s record high, their biggest ever weekly loss, Bloomberg reports. Still, demand for housing remains strong as ever, with mortgage and refinance applications up from the previous week, according to the Mortgage Bankers Association.

In the Twin Cities region, for the week ending June 12:

- New Listings increased 9.5% to 1,894

- Pending Sales increased 4.6% to 1,531

- Inventory decreased 42.4% to 6,109

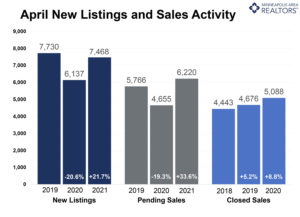

For the month of April:

- Median Sales Price increased 16.6% to $343,750

- Days on Market decreased 41.5% to 24

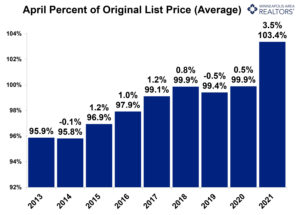

- Percent of Original List Price Received increased 4.4% to 104.0%

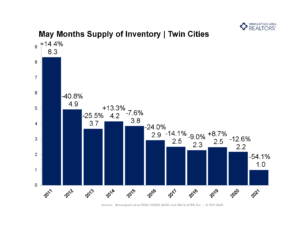

- Months Supply of Homes For Sale decreased 54.5% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

, which offers qualifying homeowners with a Fannie Mae-owned mortgage new options for refinancing their loans, officially starts on June 5th. Borrowers at or below 80% of the area’s median income may qualify for this new program, which can lower interest rates and reduce monthly payments by $50 or more. Homeowners can learn more about qualifications and their options by contacting their lender or visiting KnowYourOptions.com.

, which offers qualifying homeowners with a Fannie Mae-owned mortgage new options for refinancing their loans, officially starts on June 5th. Borrowers at or below 80% of the area’s median income may qualify for this new program, which can lower interest rates and reduce monthly payments by $50 or more. Homeowners can learn more about qualifications and their options by contacting their lender or visiting KnowYourOptions.com.