For Week Ending May 1, 2021

For Week Ending May 1, 2021

The National Association of Home Builders’ latest Housing Trends Report found that in Q1 2021, 16% of American adults were looking to purchase a home in the next 12 months, up from 10% from a year ago and now at the highest level since Q1 2018. The Millennial generation saw the largest change in expectations year over year, with 32% planning to buy in the next 12 months, double the levels seen in Q1 2020.

In the Twin Cities region, for the week ending May 1:

- New Listings increased 10.8% to 1,730

- Pending Sales increased 25.5% to 1,534

- Inventory decreased 47.8% to 5,406

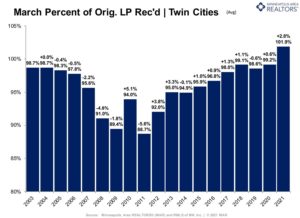

For the month of March:

- Median Sales Price increased 10.5% to $328,231

- Days on Market decreased 36.1% to 39

- Percent of Original List Price Received increased 2.7% to 101.9%

- Months Supply of Homes For Sale decreased 47.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.