For Week Ending July 28, 2018

The U.S. Labor Department reported that the economy added 157,000 jobs in July, marking 93 months in a row of job additions. Beginning in October 2010, that is the longest streak of monthly employment growth on record. The unemployment rate dropped to a historically low 3.9 percent, and wage growth remained at an annual rate of 2.7 percent. Meanwhile, escalating tariff conflicts with U.S. trade partners have not yet impacted the day-to-day housing market, but builders have indicated that lumber tariffs are increasing prices for new homes.

In the Twin Cities region, for the week ending July 28:

- New Listings increased 6.1% to 1,814

- Pending Sales increased 2.0% to 1,401

- Inventory decreased 12.5% to 11,959

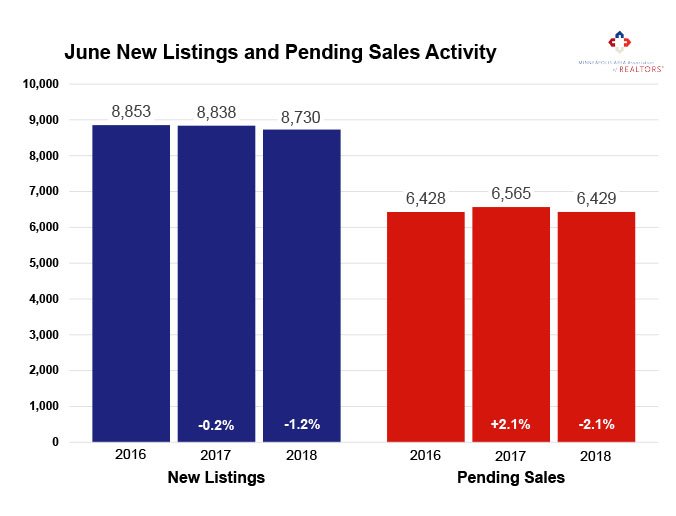

For the month of June:

- Median Sales Price increased 5.3% to $271,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 11.1% to 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.