For Week Ending February 3, 2018

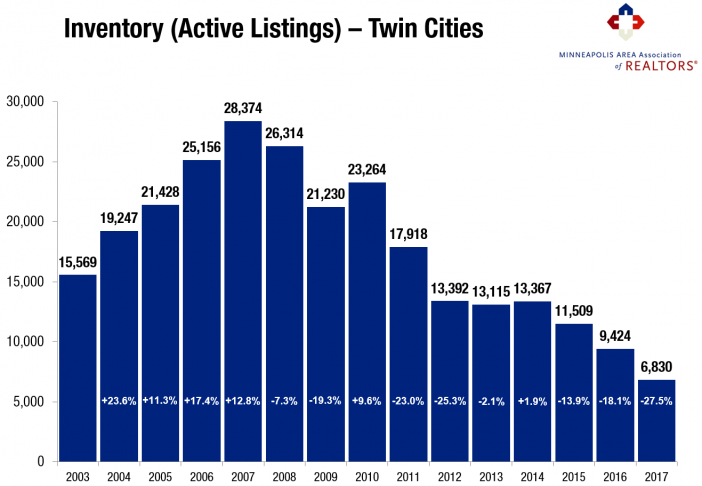

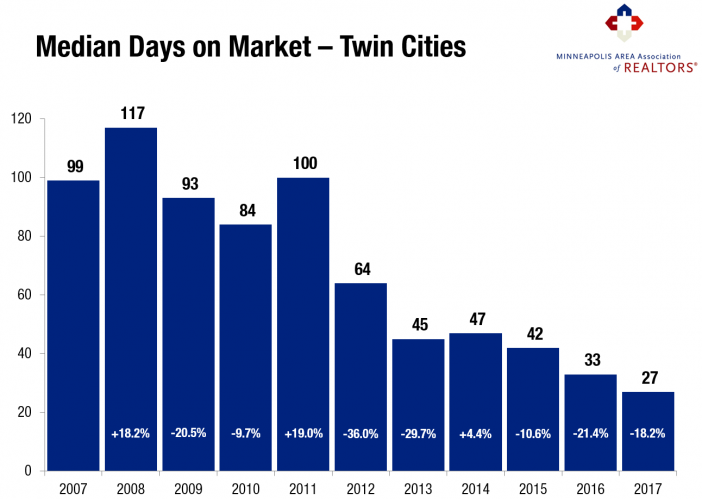

As we get beyond the newness of the year and into the idea that 2018 is here and now, there is plenty of excitement about the promise presented within strong economic conditions and an active real estate market. Buyers are taking fresh listings that show well off the market in short order, and it is evident that the lack of inventory is driving prices up and market time down.

In the Twin Cities region, for the week ending February 3:

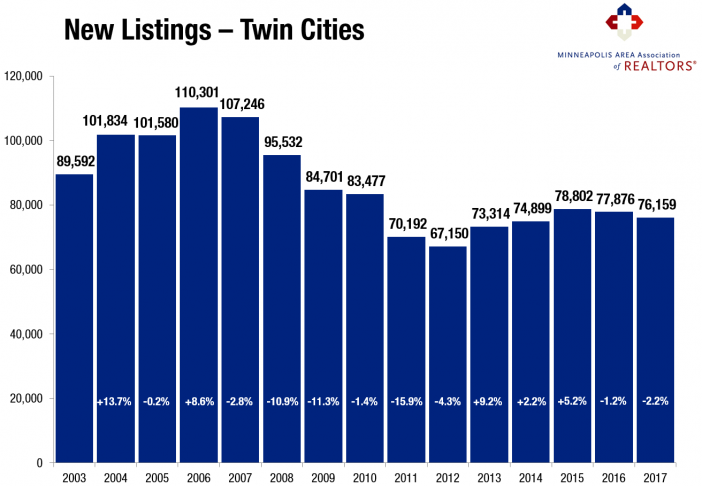

- New Listings decreased 24.2% to 1,000

- Pending Sales decreased 19.3% to 767

- Inventory decreased 25.0% to 7,062

For the month of December:

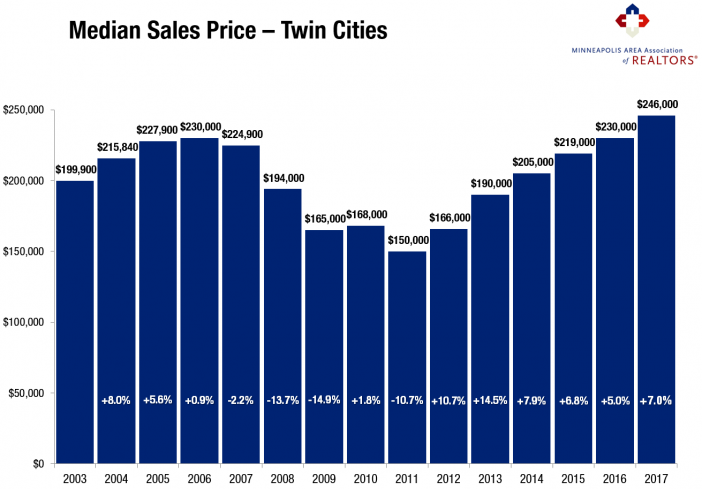

- Median Sales Price increased 9.7% to $248,000

- Days on Market decreased 15.3% to 61

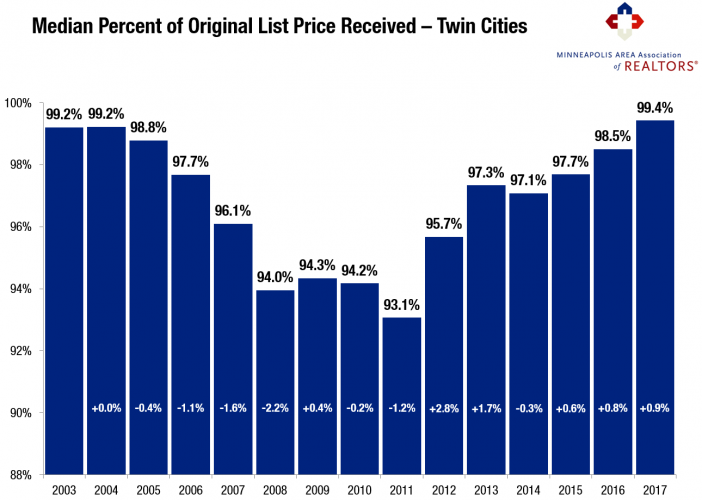

- Percent of Original List Price Received increased 1.3% to 97.1%

- Months Supply of Inventory decreased 26.3% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.